Blog

Winning Multinational Rollouts Across Latin America with Dedicated Servers

Latin America is no longer a “remote region” you serve from Miami, Ashburn, or Frankfurt and hope for the best. Investment, new capacity, and user expectations are moving too fast for that. IDB Invest estimates the region’s data center market will nearly double—from roughly $5B (2023) to almost $10B (2029)—and notes ~30 new data centers under construction or recently inaugurated.

But CTOs don’t win LATAM by copy/pasting a global template. They win with a unified rollout playbook that treats the region as it is: multiple regulatory regimes, multiple last-mile realities, and multiple connectivity “truths,” even when the map looks contiguous.

This playbook is focused on three levers that make or break a multinational rollout:

- Procurement: how you standardize hardware decisions while staying locally realistic.

- Network blend: how you keep transit and peering from becoming a black box.

- Monitoring: how you measure latency, loss, and availability the same way everywhere.

And because Brazil is both the biggest prize and the most common misstep, we’ll define when Brazil should be your primary origin and where secondary nodes should live.

Servers in LATAM— Reserve server hardware in Brazil — CDN PoPs across 6 LATAM countries — 20 DCs beyond South America |

Why a Global Template Breaks for a LatAm Dedicated Server Rollout

A global template typically assumes three things that fail in Latin America:

- Latency is geographic. In practice, it’s often policy + peering + congestion + last-mile.

- Your origin can sit outside the region. That works until cross-border jitter breaks real-time apps, or regulation demands local processing.

- One monitoring plane is enough. In LATAM, you need coordinated monitoring across countries, not just a single “green dashboard” from a U.S. vantage point.

The fix is not “more regions.” It’s a unified playbook that makes deployments repeatable while letting topology stay locally intelligent.

Procurement: Treat Dedicated Server in South America as a Supply Chain Decision

If you’re expanding fast, procurement is where rollouts quietly die—usually via inconsistent server SKUs, uneven spares strategy, and “temporary” instances that become permanent.

A procurement model that survives LATAM has three layers:

- Standardize server families, not exact SKUs. Pick 2–3 CPU/memory/storage archetypes aligned to your workloads (API, DB, cache/stream). Keep the bill of materials flexible enough to land locally without re-architecting.

- Standardize port and traffic assumptions per role. Origin nodes are not edge nodes. Your origin may need higher sustained egress and predictable routing control; edges need burst-friendly delivery and fast cache turnover.

- Standardize the deployment contract. Imaging, secrets, config management, and observability must be identical whether the node is in Brazil or elsewhere.

For Brazil specifically, plan around the reality that São Paulo is the procurement + connectivity center of gravity. São Paulo is one of the most interconnected hubs and a practical foundation for LATAM architectures.

Network Blend per Country: Stop Treating “Transit” as a Single Line Item

In LATAM, the network blend is not just cost optimization. It’s your latency distribution, your loss profile, and your incident radius.

A functional model:

- Pin your performance targets to SLOs, not to providers. Your SLO is what matters; providers are just knobs.

- Design for country-local exit where it matters. If your traffic regularly hairpins across borders to find a peering point, you’ll see random “bad days” you can’t reproduce.

- Use BGP only when you can operationalize it. Routing control is powerful, but only if you monitor route changes, maintain prefix hygiene, and have a clear rollback playbook.

On the Melbicom side, BGP sessions are available (including BYOIP) for free on dedicated servers—useful when you want deterministic routing behavior across regions without rewriting your architecture.

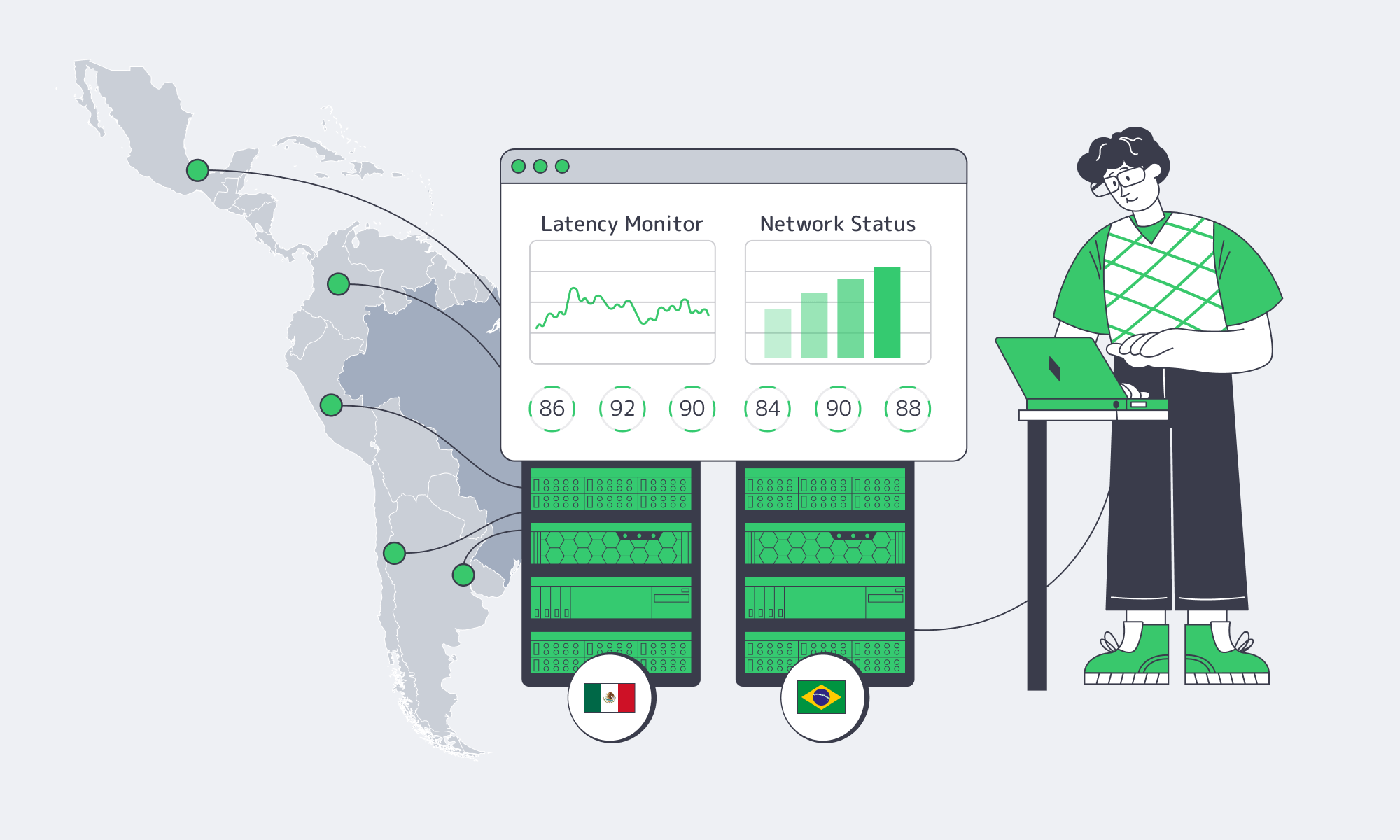

Coordinated Monitoring: One SLO, Many Vantage Points

The classic failure mode: your monitoring says “fine,” users in Bogotá say “broken,” and the network team can’t reproduce the problem from outside the region.

Coordinated monitoring means:

- One SLO definition across the rollout (p95 latency, packet loss, HTTP error budgets, stream join time, etc.).

- Multiple vantage points inside the region and across borders so you can distinguish “Brazil is down” from “Argentina-to-Brazil transit is degraded.”

- A single correlation model: BGP changes, CDN cache hit ratio shifts, and origin load must be visible in the same incident timeline.

This is where “global template thinking” fails hardest. LATAM needs a shared measurement language, not a single measurement location.

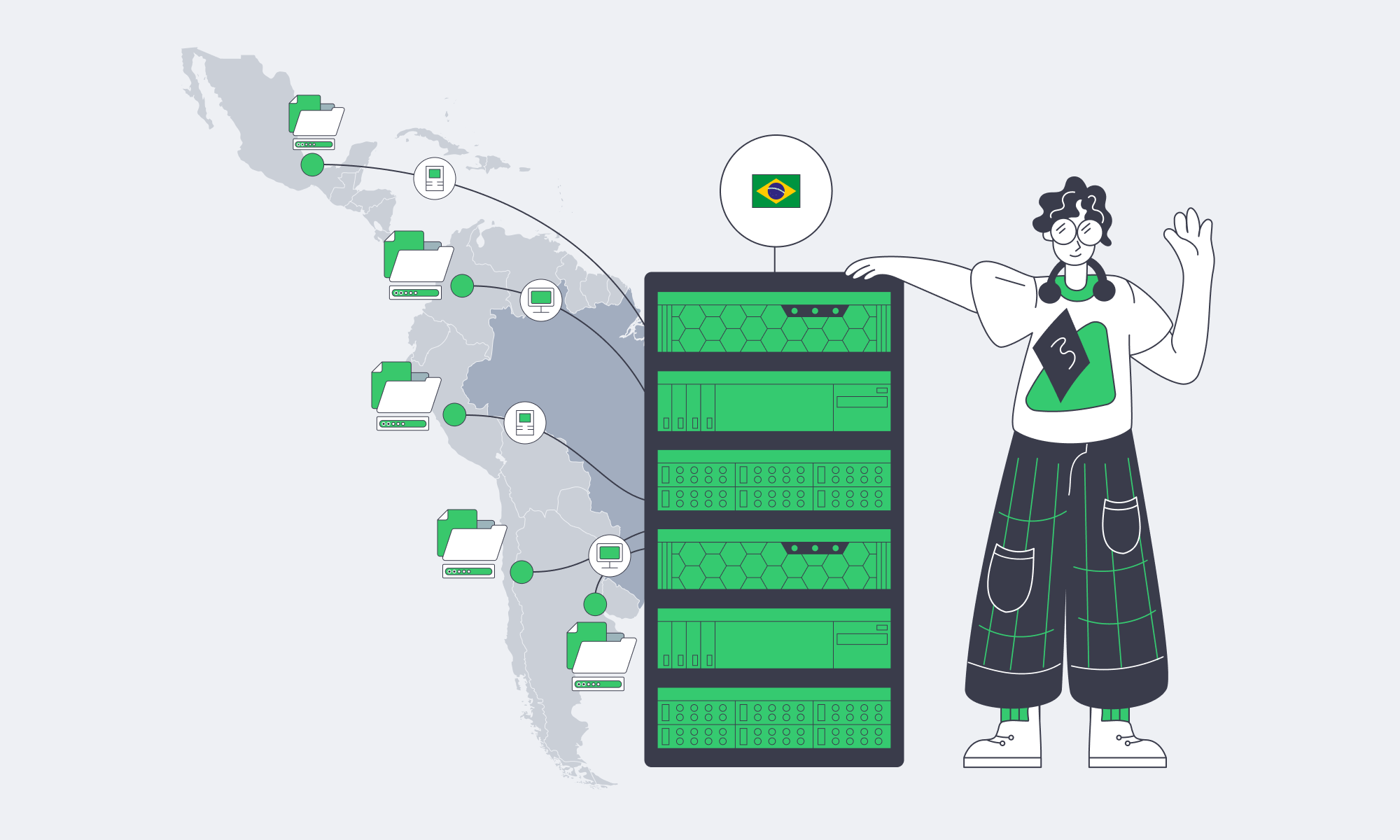

Brazil Dedicated Server as the Primary Origin: The Rule, the Exception, the Reality

Brazil is the easiest place to overfit. It’s huge, economically central, and network-dense—but it’s not automatically the best origin for every LATAM deployment.

When a Brazil Dedicated Server Should Be Your Primary Origin

Use Brazil/São Paulo as the primary origin when at least one of these is true:

- Brazil is your largest market (user volume, revenue, or regulatory risk).

- Your application is sensitive to peering gravity. São Paulo’s IX.br ecosystem is a real differentiator when you need to reach into Brazilian networks.

- Your workload is latency-sensitive inside Brazil. The 2–3 ms round-trip latency within the São Paulo–Rio corridor is exactly the type of metric that matters for fintech, trading, and real-time iGaming systems.

- You need routing control at the origin. If you’re doing multi-region failover or traffic steering, control belongs at the origin, not only at the edge.

When Brazil Should Not Be Your Only Origin

Brazil-as-only-origin breaks when:

- Your users cluster heavily in Mexico or the northern tier (crossing multiple borders to reach São Paulo creates a wide jitter envelope).

- Your risk model can’t tolerate a single “regional heart.” A São Paulo issue shouldn’t become a LATAM-wide incident.

- Your app’s write-path is globally chatty (e.g., synchronous cross-service dependencies). In that case, the origin must be closer to the majority of your request graph, not just the biggest map country.

Where to Add Secondary Nodes—and What They Should Do

Secondary nodes are not mini-origins by default. Their job is to absorb latency, isolate incidents, and localize delivery.

A practical pattern for LATAM:

- Brazil/São Paulo as primary origin for data gravity

- Secondary nodes as delivery + resilience points in the largest non-Brazil demand centers

For Melbicom specifically, the current LatAm CDN footprint includes PoPs in São Paulo, Santiago, Buenos Aires, Lima, Bogotá, and Mexico City (useful for “near-user” delivery when the origin is centralized). This is how you keep the LATAM delivery redundant even when the origin is in one country.

Table: Practical Topology Patterns for Multinational LATAM Rollouts

| Pattern | Primary Origin | Secondary Nodes (Role) |

|---|---|---|

| Brazil-centric LATAM | São Paulo | Santiago / Buenos Aires / Lima / Bogotá / Mexico City as delivery nodes (cache, acceleration, fail-soft) |

| Split LATAM delivery | São Paulo | Two “anti-hairpin” secondary nodes aligned to demand clusters (e.g., Pacific vs. Southern Cone) |

| Resilience-first | São Paulo | Secondary nodes sized for “read-heavy continuity” during origin degradation (serve cached, degrade writes) |

A Unified LatAm Dedicated Server Playbook

A unified playbook is not a template. It’s a contract:

- Treat LATAM as multiple network domains: build one rollout system, but allow topology to vary by country.

- Choose São Paulo as origin when Brazil traffic/compliance dominates; otherwise, avoid making it your only “regional heart.”

- Add secondary nodes to prevent hairpin latency and to keep incidents local; size them for the failure mode you’re willing to tolerate.

- Make routing control operational (or don’t do it): BGP without monitoring and rollback is just chaos with better vocabulary.

- Run coordinated monitoring with in-region vantage points so you can separate “origin issues” from “cross-border path issues.”

- Lock procurement to server families and role-based bandwidth assumptions so your rollout doesn’t stall on SKU mismatches.

Deploy, Customize, and Scale LatAm Infrastructure With Melbicom

Melbicom can help you finalize this blueprint. We’re opening priority access for teams preparing LatAm rollouts anchored in Brazil. Share your traffic profile, hardware requirements (CPU/GPU, NVMe tier, port targets, redundancy and DDoS posture), and timelines, and we’ll shape a tailored offer and pre-stage capacity across our network and LatAm CDN—with first-wave placement when São Paulo dedicated servers go live.

Plan your LatAm rollout with Melbicom

Share your traffic profile and hardware needs. We’ll validate routes, size capacity, and pre-stage Brazil origin with CDN and DDoS options across LatAm.