Blog

Brazil Unmetered-Port Servers and CDN for Boosting Conversions

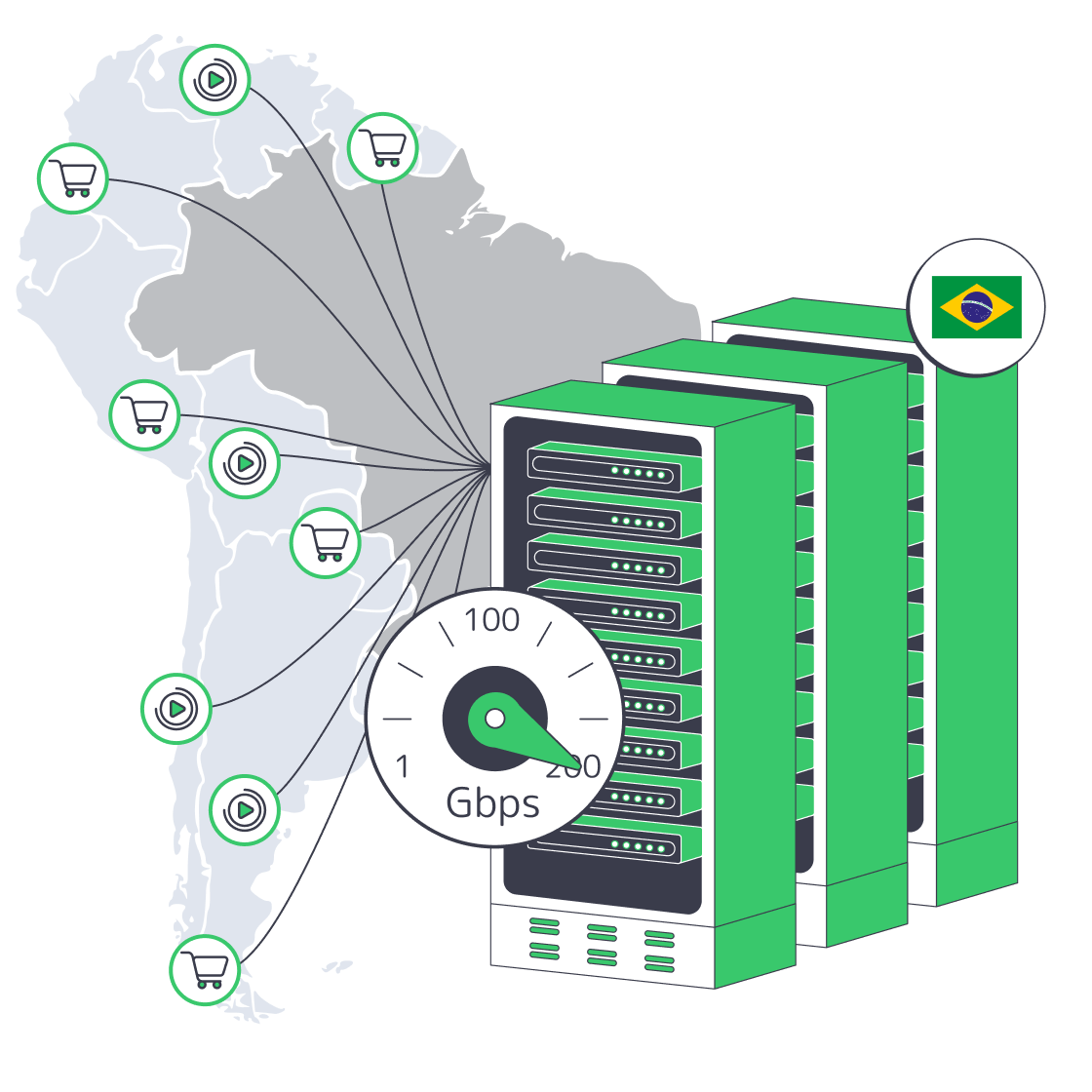

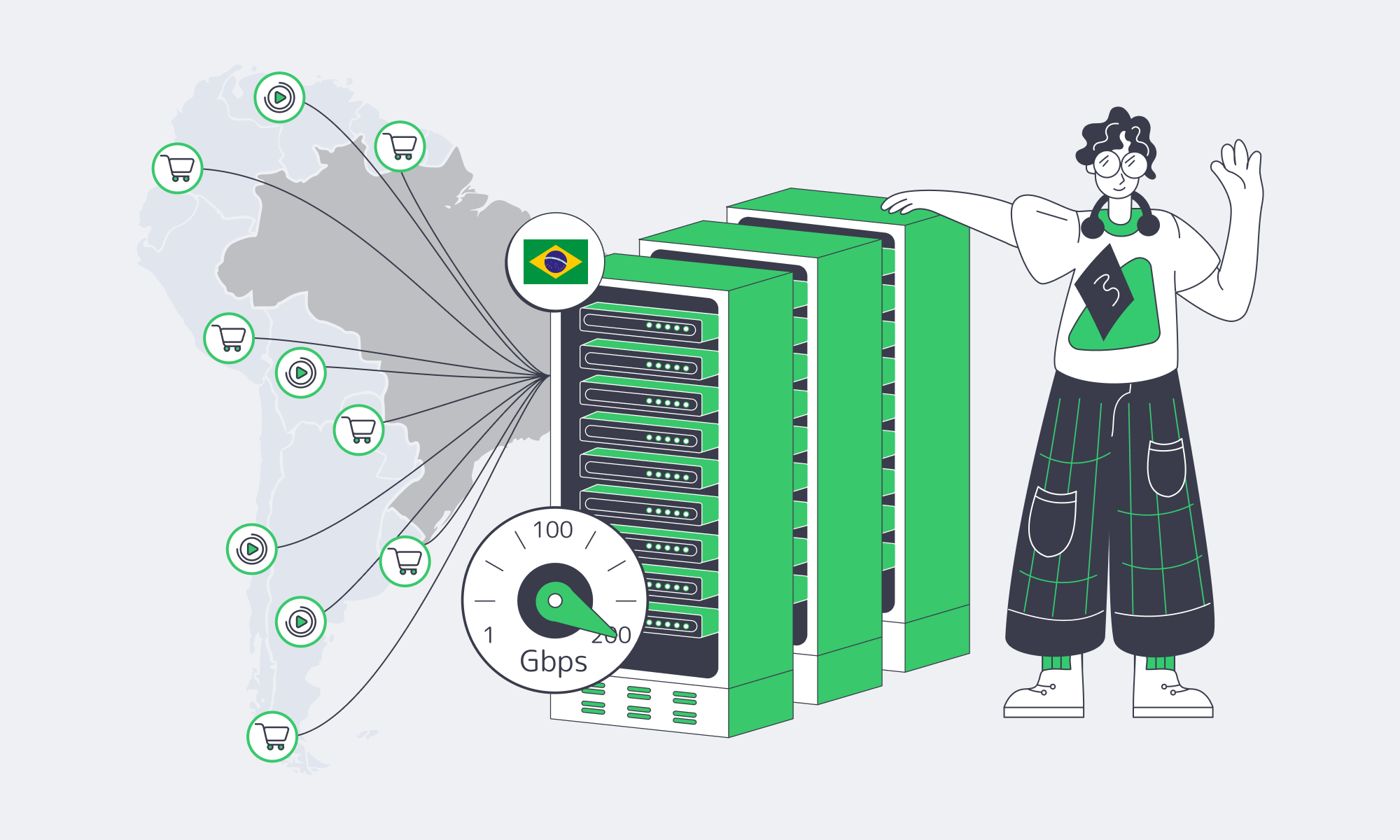

The online economy in Brazil has seen a substantial surge in the last few years, which will only continue with revenue projections for retail e-commerce of around US$36.3B and a widely addressable market of approximately 94M online shoppers. The high-traffic stores and video platforms are bandwidth‑heavy and subject to spikes, especially in the cases of flash‑sale checkouts and live premiere streams. When your site traffic multiplies in minutes, the infrastructure needs to be able to cope. An infrastructural blueprint to facilitate the demands would be the following: unmetered ports on dedicated servers at local Brazilian origins that can be autoscaled by simply adding additional nodes and edge cache via a CDN with PoPs in South America. If well executed, even volatility can still spell revenue; you have faster checkouts and higher stream start rates, which equate to fewer abandons.

Host in LATAM— Reserve servers in Brazil — CDN PoPs across 6 LATAM countries — 20 DCs beyond South America |

Low Latency Dedicated Server Hosting in Brazil for Better Conversion Rates

Physical infrastructure distance adds delay. Typical trans‑oceanic round‑trip times can exceed 100 ms because physics (speed of light in fiber ≈ 200,000 km/s, ~4.9 µs/km) sets a hard baseline and real networks add additional overhead. By hosting your origins within Brazil, you can shave hundreds of milliseconds from user paths compared with serving São Paulo from North America or Europe. Google has reported that bounce probability rises by 32% as page load time increases from 1s to 3s, and video studies show that viewer abandonment rises by about 5.8% per additional second when startup is delayed beyond 2s. Fortunately, these revenue leaks can be closed by addressing the infrastructural locality.

How Much Unmetered Bandwidth Do 1/10/100+ Gbps Ports Deliver?

By opting for an unmetered port, you aren’t limited by a monthly GB quota, which means no egress overages from any spikes from a sudden viral promotion or premiere. The port is the limit, and the scale is easily quantifiable:

| Port speed (unmetered) | Max transfer/month* | Approx. concurrent 1080p streams |

|---|---|---|

| 1 Gbps | ~324 TB | ~200 |

| 10 Gbps | ~3.24 PB | ~2,000 |

| 100 Gbps | ~32.4 PB | ~20,000 |

| 200 Gbps | ~64.8 PB | ~40,000 |

The above table is calculated on the assumption of a 30‑day month, 24×7 full utilization, ~5 Mbps per 1080p stream.

With the headroom offered by an unmetered port, e‑commerce stores won’t suffer from uplink saturation during peak checkouts, and tens of thousands of HD streams per node group can stream without the network being throttled. You also have the bonus of a predictable flat‑rate price for your bandwidth, and rest assured that a successful launch won’t incur the egress seen with per‑GB cloud operation.

Revenue‑Focused Planning for Dedicated Hosting in Brazil

When sifting through cheap dedicated server Brazil offers, you should look beyond the price alone and consider the total cost of performance:

- Place origins in‑region to minimize round‑trips for dynamic calls (cart, auth, APIs) and initial stream manifests.

- Provision unmetered ports sized to peak—start with 10 Gbps, and if your daily peaks hit multi‑Gbps scale to 40/100/200 Gbps with your audience.

- Offload everything cacheable to a local CDN to free up the origin to focus on compute and cache misses.

- Autoscale horizontally with a design that allows you to bring additional nodes online rapidly as traffic climbs.

Which workload economics and use cases justify 100–200 Gbps per server?

Video makes up an estimated 82% of global consumer traffic; with that in mind, pragmatic planning is a requirement, not an extravagance:

- For OTT premieres and live events: Thousands to tens of thousands of concurrent FHD/UHD sessions per port tier with AV1/HEVC playback for better efficiency.

- High‑SKU storefronts with rich media: Having a 10–40 Gbps pipe helps for product detail pages with multiple images and video during campaigns.

- Moving large data: 40/100 Gbps links reduce times for nightly replication, object store rebalancing, and preload jobs completion, which reduces maintenance windows.****

Proving Revenue Impact

Financially speaking, two performance levers carry boardroom weight:

- Millisecond conversion: Speed moves revenue as observed by Amazon, which found that every +100 ms of latency costs ~1% of sales.

- A slow start loses the viewer: Studies show a rise in abandonment when the startup exceeds 2s, with 5.8% per additional second.

Shave RTTs, cut startups, lift conversions, and engagement by tying the above performance levers to local‑origin plans.

Autoscaling without Cloud Lock‑In

Autoscaling on dedicated servers is easy, provided the architecture is correct:

- To scale horizontally: App tiers should be kept stateless behind a load balancer to scale out with additional nodes, either reserved, on‑hand, or provisioned from inventory. They can then be added to the pool in moments through containerization and automation.

- For traffic distribution: Steer traffic to the least-loaded or nearest node via anycast/geo‑DNS.

- Scaling stateful layers: Leverage read replicas, partitioning, or distributed SQL for databases and segment writes where necessary.

- Automation & SLO‑based triggers: Monitor CPU, RPS, p95 latency, port utilization, and let telemetry trigger scripted capacity addition for known peaks such as drops, sales, or hot title premieres.

CDN in Brazil: Why Edge Caches Matter

While a local origin speeds processes to compress user-perceived distance, edge caching plays a crucial role. Melbicom has an extensive CDN that spans 50+ PoPs in 36 countries with South American edges in São Paulo, Buenos Aires, Santiago, Bogotá, Lima, among others. That allows you to serve up cacheable assets such as product images, JS/CSS, thumbnails, HLS/DASH segments from the nearest PoP, letting your origin deal with dynamic and cache misses, resulting in faster first paint and startup, higher cache‑hit ratios, and lower origin egress/CPU—especially during flash crowds.

Moving playlists and segments to the CDN helps with video workloads, and setting strong cache‑control and using Brotli/HTTP‑2/TLS 1.3 at the edge helps with heavy lifting on the web. All of which works to keep your origin focused on transactional logic.

Rollout Checklist for Dedicated Server Hosting in Brazil

- Baseline measurement: Record current RTT from Brazilian metros to your existing origins and compute peak Mbps/Gbps needs for checkout and playback using 1080p ~5 Mbps / 4K ~15 Mbps as a sizing guide for streaming peaks.

- Choose a Brazilian data‑center footprint: Prioritize proximity to São Paulo and make sure upgrade paths from 1/10 Gbps to 100/200 Gbps per server.

- Deploy origins and harden: Tune stacks for latency. Secure transport and enable observability.

- Wire up CDN PoPs in Brazil and across South America: Cache your static assets, thumbnails, and HLS/DASH segments. Confirm cache‑hit ratios before launching.

- Engineer to autoscale: Keep stateless app tiers behind load balancers and use a scripted add‑node flow based on telemetry to bring additional servers online at peak.

- Optimize: Compress, minify, lazy‑load, and use adaptive bitrate ladders.

- Load‑test: Validate NIC utilization, CPU headroom, and CDN offload with Brazil‑sourced traffic at peak and pre‑approve upgrades to 10/40/100 Gbps if tests approach saturation.

- Instrument business KPIs: keep track of LCP/TTFB/startup time vs. conversion/engagement in Brazil and publish weekly infra‑to‑revenue dashboards.

Conclusion: Building for Locality, Bandwidth, and Freedom

Brazil is best served by a plan that marries locality (origins in‑country), capacity (unmetered 1/10/200 Gbps ports sized to peak), and distribution (Brazil‑centric CDN caches) with pragmatic autoscaling via additional nodes. That combination reduces round‑trips, prevents uplink saturation during surges, and converts traffic spikes into revenue—faster checkouts, quicker video starts, steadier retention. While we finalize local dedicated‑server capacity, we at Melbicom can support your launch in the near term: stage the architecture on our existing global 21-DC footprint, front it with our South American CDN PoPs, and pre‑provision hardware/network profiles so your move to in‑country origins is a switch‑flip, not a rebuild.

Unlike typical providers, Melbicom is built around Infrastructure Freedom. In practice, that means deployment freedom (run anything, anywhere, at any scale), configuration freedom (tune hardware and network to your spec), operational freedom (own the stack end‑to‑end), and experience freedom (straightforward onboarding and clear controls). Share your targets; we’ll shape a build that matches them exactly and transitions cleanly to local Brazil capacity as it comes online H1 2025.

Be the first to host in Brazil on special terms

Tell us your peak traffic volumes, target port speeds, bitrate, cache rules, regions, and exact hardware/network specs—and we’ll return a tailored rollout plan with early‑placement options and South America CDN acceleration from day one.