Blog

Germany’s Servers Blend Savings With Low Latency

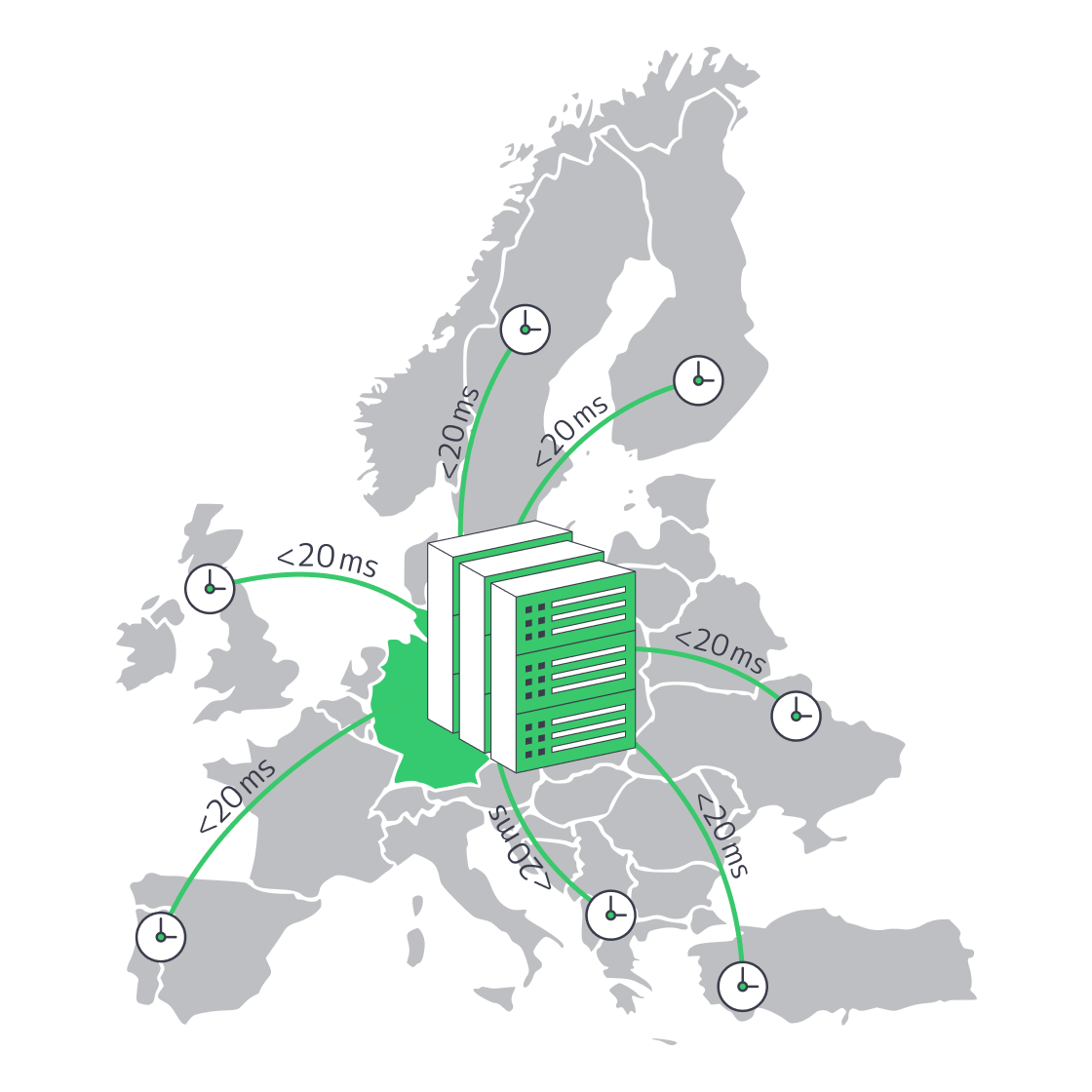

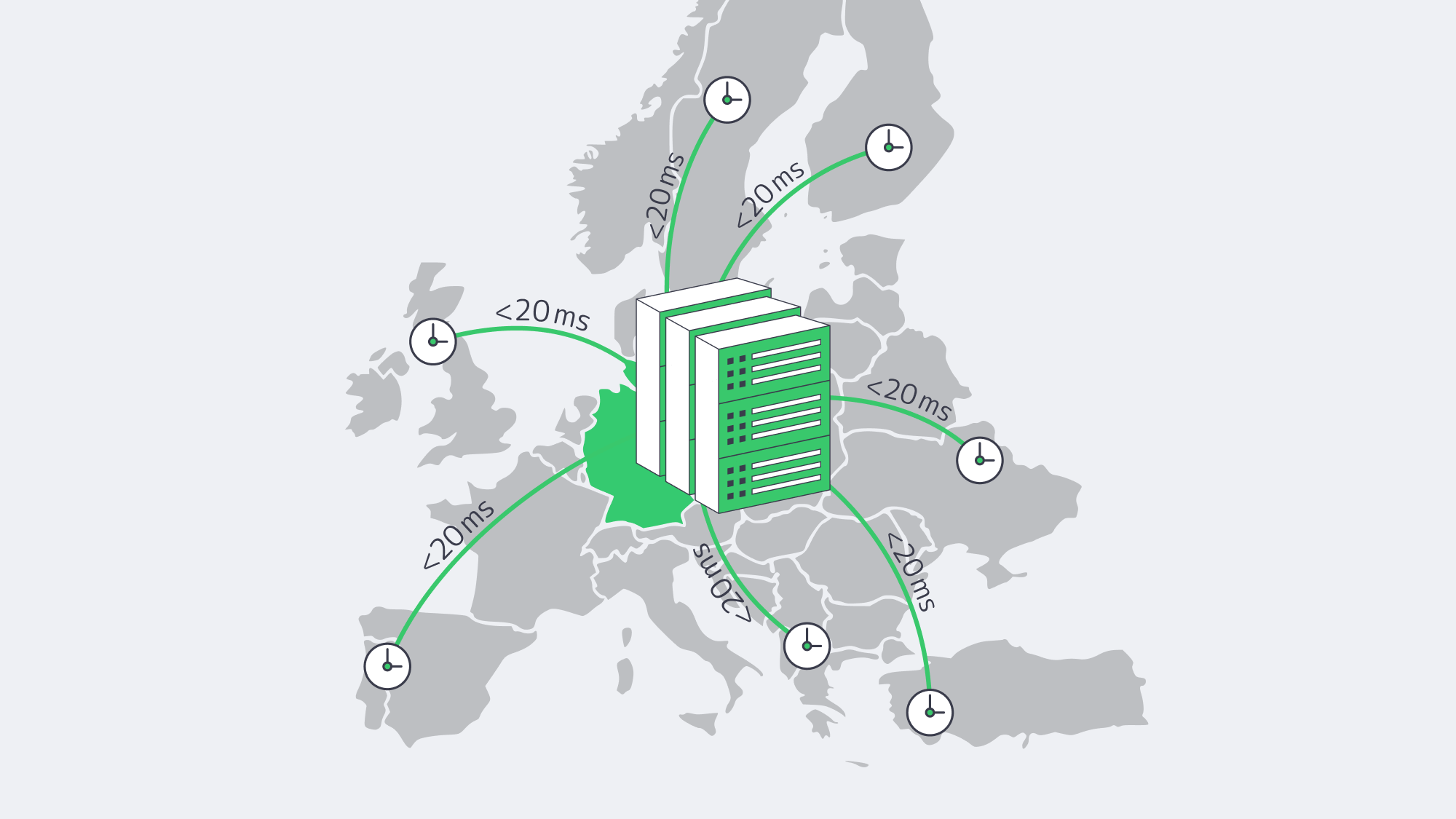

The German hosting sector has been developing rapidly to become the default hosting location for startups with limited budgets that must meet enterprise-level performance metrics. Frankfurt is the ecosystem’s center of gravity; it hosts DE-CIX, the most active internet exchange point in the world, along with a concentration of Tier III+ data centers that guarantee a round-trip time of under 20 ms to most major European capital cities. Competition is intense and hardware is getting aggressive, coupled with burstable 95th percentile bandwidth plans and requirements to be efficient globally. This is indeed a challenge to keep up with: by reducing the TCO, with no loss of speed, resiliency, or scale.

Choose Melbicom— 240+ ready-to-go server configs — Tier III-certified DC in Frankfurt — 55+ PoP CDN across 6 continents |

|

Why a Cheap Dedicated Server in Germany Still Delivers Enterprise Muscle

Server pricing in Germany is based on the economics of supply and demand. Frankfurt alone exceeds 700 MW of installed IT power, second in Europe only to London, with vacancy rates just under 7 percent, which is forcing providers to sharpen their pricing strategies.[1] Industry veterans on WebHostingTalk have long observed that “Germany is actually the cheapest place in Europe to buy a dedicated server”[2] as compared to the U.S. coastal cities, where land, labor, and power costs are driving up monthly costs.

Competition shows up on invoice line items:

| Spec | Typical Monthly Price | Note |

|---|---|---|

| 8-core Xeon / 32 GB / 1 Gbps | €110–€140 | Port usually unmetered at 1 Gbps |

| 16-core EPYC / 64 GB / 10 Gbps | €220–€280 | Burstable to 20 Gbps on 95th-percentile |

| 32-core EPYC / 128 GB / 25 Gbps | €450–€550 | High-frequency trading & AI edge |

The second cost lever is flexible burstable billing. Most German operators bill on the 95th percentile, allowing customers to exceed their commitment by two or three times in the short run without penalty.[3] If done at the time of a SaaS launch, or a FinTech hit by international news, that allows headroom when traffic soars, but no spending on the purchase of bandwidth for the rest of the month.

The hardware specification is also quite lavish; even the entry-level models come with current multi-core CPUs and SSD storage. Single-core legacy boxes can only be found in a museum rack and should not be considered in a 2025 capacity plan at all.

Energy-Efficient Tier III+ Facilities Cut Opex

TCO consists of capital outlay, and power is its other half. As of mid-2026, energy intensity needs to achieve PUE ≤ 1.2 in any new data center. Existing halls will be required to reach ≤ 1.3 by 2030.[4] Cooling and power-train overhead are being squeezed so tightly that electricity is effectively becoming a pass-through expense, rather than a profit center. This means tenants will enjoy reduced price per kilowatt and stable utility overcharges, despite increasingly dense workloads.

How Does DE-CIX Peering from Frankfurt Cut EU Latency?

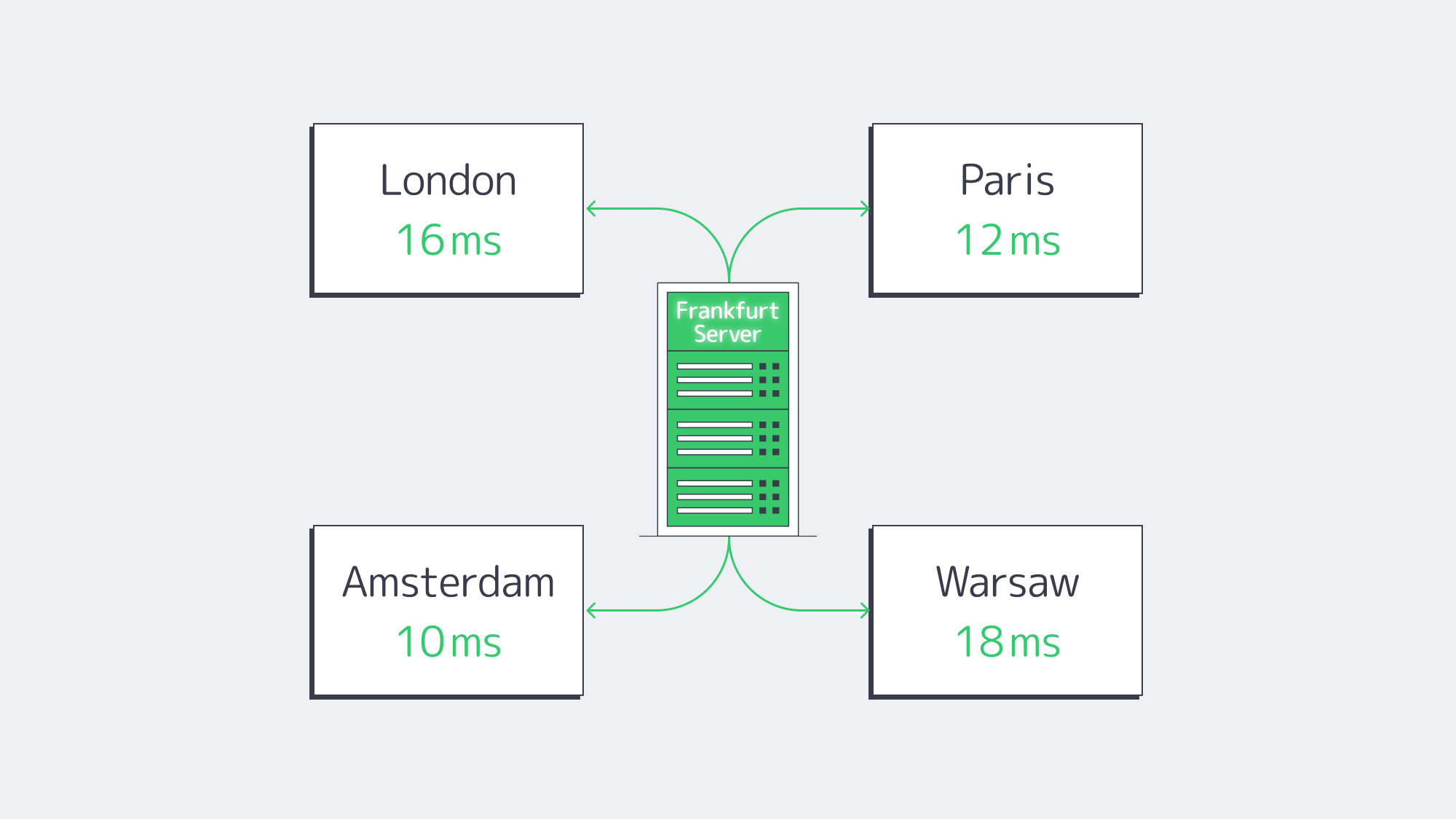

Frankfurt moves packets like no other European city. In November 2024, DE-CIX Frankfurt reached a record high of 18.1 Tbps, holding the highest single-site traffic throughput globally.[5] It supports over 1,100 networks on its exchange, with most of its end-user routes staying on-exchange, eliminating milliseconds of backtracking. Geography takes care of the rest: Frankfurt lies roughly equidistant from London, Paris, Amsterdam, and Warsaw, keeping fiber miles to a minimum.

Typical round-trip times (RTT):

| City | RTT (ms) | Source |

|---|---|---|

| London | 16.5 | wondernetwork.com |

| Paris | 12.0 | wondernetwork.com |

| Amsterdam | 9–11 | DE-CIX Looking-Glass |

Why Do Sub-20 ms Latency Numbers Matter for Users and APIs?

An API in Frankfurt can be faster for a London-based fintech client compared to a London-based API reaching Warsaw. Frankfurt also retains ~85 ms to New York and <140 ms to the U.S. West Coast, so it is also possible to configure transatlantic SaaS residency with no user-noticeable latency.

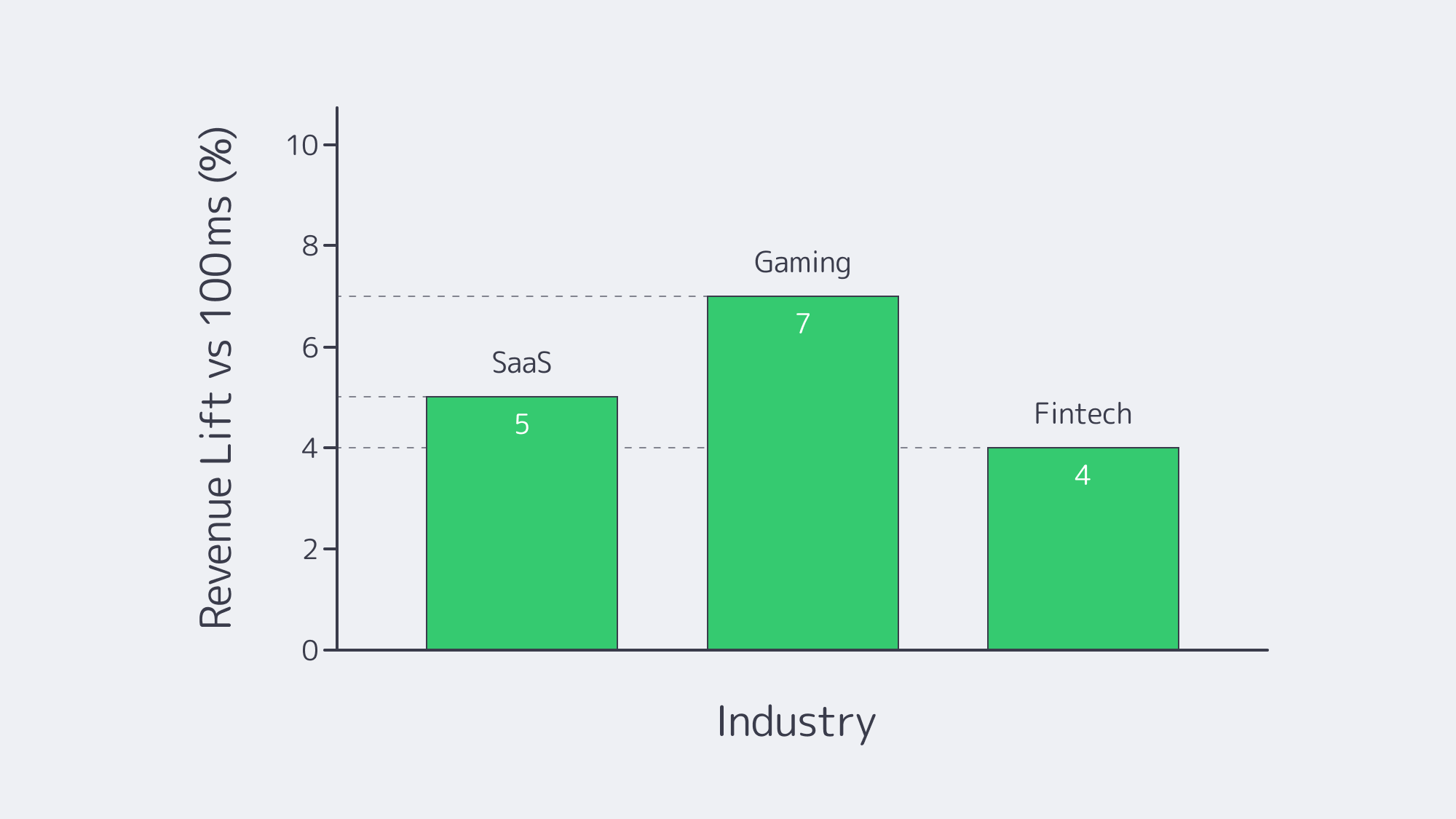

Which Industries See Revenue Gains from Lower Latency in Germany?

SaaS: Milliseconds Guard MRR

The powerful observation made by Amazon, which found that an additional 100 ms of latency reduces sales by 1 percent, is now estimated to be too low.[6] Today, Akamai can find up to 7 percent cart-conversion loss at the same 100 ms. In a SaaS company with an ARR of 10 million euros, thirty additional milliseconds can destroy hundreds of thousands of euros a year. With an anchor in Frankfurt, even a simple dedicated server in Germany ensures that UI round-trips in Europe-wide are in the teens, and a difference in the UI round-trip time between a Paris user and a Dublin user is essentially equal to the time it takes someone to react.

Fintech & HFT: Milliseconds Mean Millions

Trading desks measure latency in euros per basis point; studies of high-frequency trading demonstrate that a 1 ms delay can cost millions annually.[7] The colocation cages in Frankfurt are metres away from the Eurex and Xetra engines, so a direct fibre jumper (a cross-connect) lends < 50 µs of one-way latency, which is close to the theoretical speed-of-light limit inside the campus. Shorter round-trips between acquirer, issuer, and fraud-scoring engines also reduce card-authorisation times, lowering cart abandonment.

What Sets Melbicom’s Frankfurt Dedicated Servers Apart?

We at Melbicom rely on this German quality, but with the elimination of the acquisition hassle. There are nearly 200 configurations on the Frankfurt floor ready to deploy, including entry-level 4-core servers to GPU-accelerated servers. The stock list is updated hourly, so startups spin up real hardware—no noisy neighbours—in minutes, then scale west to Amsterdam or east to Warsaw on the same backbone. 95th-percentile burst billing comes standard, and ports upsize to 200 Gbps without requiring iperf contortions, with 24/7 support that answers calls in minutes.

Why Germany Is a Low-Latency, Cost-Efficient Choice for Dedicated Servers

Over recent years, architects have believed that they were forced to make a trade-off between low-cost servers in second-tier markets or high performance in hot markets such as London. Frankfurt turned that equation upside down. An oversupplied data-center pipeline and the gravitational effect of DE-CIX have driven price and performance to the same position on the curve, which is not common in infrastructure economics. When you can cover all of the most significant EU population centers in 20 ms or less and continue paying second-tier rates, the choice is easy.

Germany’s dedicated servers should not, then, be seen as a compromise for budget- and user-experience-driven startups, but rather as a starting point. Tier III+ energy-efficient data centers with a limit on power expenses, network expenses, burstable billing constraints, and a network of nearby peers cut latency down to single digits. Irrespective of whether the burden is a latency-sensitive trading cache or a multi-tenant SaaS application, Germany dedicated hosting can deliver without blowing the budget.

Deploy in Germany Today

Launch high-performance dedicated servers in our Tier III Frankfurt facility within minutes—enterprise bandwidth, low latency, zero setup fees.